Secure Your EB-5 Investment Visa for the USA

The Opportunity

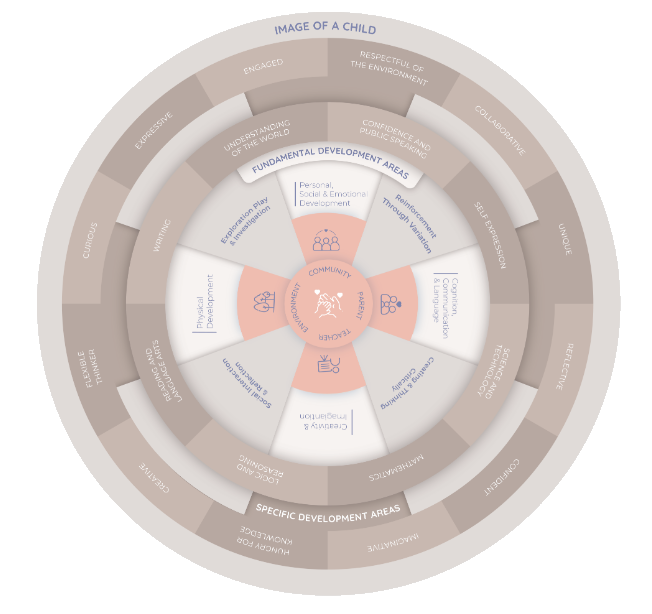

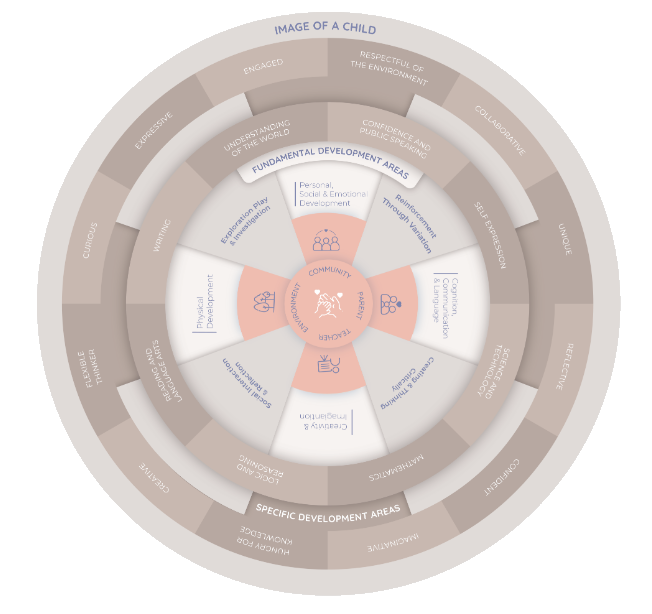

Kido - Early years, reimagined

Kido is a fast growing international chain of preschools with operations

in the USA, UK and India.

Since 2018, the Kido Group has invested millions of dollars in curating, developing and implementing tech systems for almost every aspect of an early years operation.

Our curriculum leadership team has over 100 years of combined experience in teaching and pedagogy across more than ten countries.

Kido is able to take direct EB5 investment from qualified Investors in

school projects in Texas, and has upcoming projects in the metro areas

of Houston and Austin.

20+

schools

20 preschools under operation in June 2022, across the UK, US, and India, with franchise operations in China

12+

projects

12 new pipeline schools for FY ‘22-23

$100

million

Target school revenues USD by FY ’26-’27

What We Offer

Presence

We operate preschools in the US, UK, China, and India. Our 8-year operating history includes UAE and Hong Kong.

20 Preschools

We operate 20 preschools globaly. Slated to increase to 32 in FY '22-23.

Revenue

USD 25 million school revenues in FY ‘22-23.

Petitions can be filed as soon as business/project documents are completed and source of funds documentation requirements are met, with the time to provide these varying from project to project and investor to investor.

A financial institution may loan an investor money in exchange for collateralized use of the investor’s assets for an EB-5 investment. The EB-5 assets that the EB-5 applicant invests in cannot, however, be the collaterals. The legality of the monies used to acquire the assets utilised as loan collateral must also be demonstrated to USCIS by the investor.

Although there is no fixed industry standard, loan repayment frequently occurs over a period of five years or longer to take into account the necessity of putting EB-5 funds at risk until I-829 clearance. Though repayment cannot be guaranteed, it should be noted that EB-5 regulations demand that invested funds be fully exposed to risk.

There are pros and cons – direct projects can offer greater involvement in the project and a higher ability to customize to an investors specific needs such as bringing in liquidity over time instead of all at once.There are usually higher IRRs or coupons, and the ability to own a potential income producing operating asset for a much longer duration. There is only one investor per project (by legal entity) per the newly updated regulations (RIA) which gives greater cushion for investors especially in labor intensive industries.

No, an investor’s I-526 petition that was accepted by US Citizenship and Immigration Services (USCIS) does not qualify as an exemplar petition. A regional centre submits an exemplar petition as part of its I-924 petition to become a regional centre. However, if the I-526 petition of an investor has been granted by USCIS, it indicates that the project’s business documentation have been reviewed and found to be in order. As long as their source-of-funds evidence is accepted, the other EB-5 investors in the project can anticipate I-526 clearance.

United States Citizenship and Immigration Services (USCIS) requires proof of the costs used to compute employment creation for programmes that count direct, indirect, and induced job creation. Invoices and other payment evidence may be included in this record. W-2s and payroll records must be provided for projects that only count direct employment. The requisite jobs must have been created or are in the process of being created, according to Form I-829, Petition by Investor to Remove Conditions on Permanent Resident Status. In order to complete Form I-829, investors must closely coordinate with their EB-5 project, immigration lawyer, and regional centre (if applicable). From the very beginning of the project, it is essential for the EB-5 project or regional centre to monitor economic indicators including operational revenue and the total number of employment produced. By doing this, the investor will have an easier time submitting their I-829 petition successfully and avoiding a denial. I-9 data and the project’s financial statements could also be wise to send.

Currently, all processing times are current except for investors from China, there would be no advantage to a TEA vs non TEA in a direct investment setting with the possible exception of a rural investment with a visa set aside or a project granted social or humanitarian exceptions – note that the latter would simply create faster processing and not necessarily a quicker approval, as the documentation provided on the project will always be salient to the adjudication speed. The RIA set aside for rural projects is 20%, so finding such a project can, in the short term, benefit an investor from a backlogged country.

Any ownership level is acceptable as long as I the investor makes the required investment of $900,000 or $1,800,000, (ii) the investment results in the creation of 10 or more jobs, and (iii) the investor takes part in the day-to-day operations or policy formation of the new commercial enterprise. The ownership percentage itself is irrelevant (NCE). Foreign nationals considering an EB-5 investment should be aware that direct and regional centre projects have very distinct structures.

No, a foreign national who has already submitted Form I-526 as the principal applicant cannot change that status to that of his or her spouse. The investor might withdraw the application and resubmit it, but doing so would have consequences in terms of both immigration and money (e.g., filing fees, legal expenses, administrative fees, etc). (e.g., a new priority date and, therefore, longer wait for permanent resident status).

$800,000 or greater for a project located in a TEA and $1,050,000 or greater for projects that are not seeking a TEA designation – there may be additional amounts needed to cover for administrative expenses and legal costs (usually around 10% of investment amount)

Gaining permanent residency in the United States is the goal of the EB-5 programme, and in general, returns on EB-5 investments are modest, often between 0.5 and 1.0 percent. Depending on the project, returns may be given out annually, quarterly, or even weekly. The primary of the investment must remain at risk until unconditional permanent resident status is given; while a return on investment is allowed, a return of the investment is not.

EB5 Investments with Kido are quick, easy, with no extra costs (except attorney fees). Direct interaction with management, high returns, comfortable job creation and complete line of sight on the project makes it a better investment than Regional Centre projects.

The main difference between the two is that, in a regional center program, you invest in a business through a business entity that has been USCIS approved for such purposes in the past while, in a traditional direct program, you invest directly into the enterprise. Regional Center projects can count indirect jobs, tend to be much larger and can cost more for the investor because of high administrative overload and compliance costs – RC projects usually take in many more investors than direct projects, which are currently allowed only 1 investor (with a FT job creation requirement of 10 jobs per investor).

Although there is no fixed industry standard, loan repayment frequently occurs over a period of five years or longer to take into account the necessity of putting EB-5 funds at risk until I-829 clearance. Though repayment cannot be guaranteed, it should be noted that EB-5 regulations demand that invested funds be fully exposed to risk.

This is highly specific to the project – a quality direct investment in the right location and the right management team can provide a pathway to a green card and also be a great investment in its own right. In a RC setting there can be a competition for jobs with investors from non backlogged countries getting access to the job creation ahead of those from heavily backlogged countries, and complete dependence on the RC management for documentation and support. The truth is that some projects such as those that rely on labor and can easily create direct jobs such as in education, lend themselves better to a direct model while others that are more capital and construction intensive are a better fit for RC. Some direct projects that are in critical socially needed areas such as care may have a chance to get an expedited status, further speeding up adjudication.

Kido's Global Operations

Kido is a fast growing international chain of preschools with

operations in the USA, UK and India.

Kido is able to take direct EB5 investment in school projects in Texas, and has upcoming projects in the metro areas of Houston and Austin.

Market Fundamentals

- Strong demand for childcare in the US

- Texas is one of the fastest growing states in the US

- Strong government support for childcare, including grants

- Industry is resilient to inflation and recession

Flexible Structure

- Investment can be in preferred equity or common equity format,

depending on investor preference. - Investors can choose to stay involved in the business post green

card and arrival to the USA - Significantly higher returns than typical Regional Center Investments,

with investor protection - Flexible investment schedule instead of upfront capital

EB5 Experience & Ecosystem

- 5 Kido EB5 investors have already filed I-526 petitions

- Strong network of attorneys experienced in EB5 process,documentation and helping investors get their green cards.

Sponsor Equity and Project Status

- 50-55% equity contributed by Kido

- Network of real estate developers and agents in Texas to lock down desirable sites quickly

- Several projects already under discussion

- Kido’s success is driven by the vision and dedicated work of a talented and passionate management team

- Entrepreneurial mentality with a focus on providing best experience for parents and children

- 35 years of collective experience at Kido, with dedicated founding team committed to its vision

- Management’s consistent focus on technology has positioned the Company for strong future growth

- Supported by a deep, strong bench of talented personnel with extensive experience growing in emerging markets

- The school will open with minimum 6 FTEs (center director, parent relationship manager, cleaners, initial teachers), regardless of the number of enrolments.

- Strict ratios (e.g. 1 teacher per 4 infants under 18m), ensure that 10 full time jobs will be created by the time the center has 30 children (15% of capacity); typically within the first six months of opening.

- In addition, the schools operate 60 hours/week. The definition of 1 FTE (for calculating jobs) is 35 hours/week. So one full time teacher is equivalent to 1.7 FTE, giving an additional cushion.

- A typical school, with a capacity of 200 children, can create 25+ full-time jobs when fully operational,

- Strict caregiving and teacher-to-student ratios mandated by law, as low as 4:1 for infants ensure job creation even at low capacities.

Kido is a fast growing international chain of preschools with

operations in the USA, UK and India.

Kido is able to take direct EB5 investment in school projects in Texas, and has upcoming projects in the metro areas of Houston and Austin.

Market Fundamentals

- Strong demand for childcare in the US

- Texas is one of the fastest growing states in the US

- Strong government support for childcare, including grants

- Industry is resilient to inflation and recession

Flexible Structure

- Investment can be in preferred equity or common equity format,

depending on investor preference. - Investors can choose to stay involved in the business post green

card and arrival to the USA - Significantly higher returns than typical Regional Center Investments,

with investor protection - Flexible investment schedule instead of upfront capital

EB5 Experience & Ecosystem

- 5 Kido EB5 investors have already filed I-526 petitions

- Strong network of attorneys experienced in EB5 process,documentation and helping investors get their green cards.

Sponsor Equity and Project Status

- 50-55% equity contributed by Kido

- Network of real estate developers and agents in Texas to lock down desirable sites quickly

- Several projects already under discussion

- Kido’s success is driven by the vision and dedicated work of a talented and passionate management team

- Entrepreneurial mentality with a focus on providing best experience for parents and children

- 35 years of collective experience at Kido, with dedicated founding team committed to its vision

- Management’s consistent focus on technology has positioned the Company for strong future growth

- Supported by a deep, strong bench of talented personnel with extensive experience growing in emerging markets

- The school will open with minimum 6 FTEs (center director, parent relationship manager, cleaners, initial teachers), regardless of the number of enrolments.

- Strict ratios (e.g. 1 teacher per 4 infants under 18m), ensure that 10 full time jobs will be created by the time the center has 30 children (15% of capacity); typically within the first six months of opening.

- In addition, the schools operate 60 hours/week. The definition of 1 FTE (for calculating jobs) is 35 hours/week. So one full time teacher is equivalent to 1.7 FTE, giving an additional cushion.

- A typical school, with a capacity of 200 children, can create 25+ full-time jobs when fully operational,

- Strict caregiving and teacher-to-student ratios mandated by law, as low as 4:1 for infants ensure job creation even at low capacities.

Families served

since inception

20

Schools under

operation globally.

Childcare capacity

FY ‘22-23

$25m

School revenues

FY ‘22-23

The Opportunity

EB5 with Kido | The Right Choice

We creating a global platform dedicated to delivering the highest quality early years

education anywhere in the world. We are integrating advances in pedagogy, technology and

design to create unique learning experiences for children, at our schools, and

in their homes

and communities.